Independent contractor taxes require careful planning and year-round attention to avoid costly penalties and maximize your business deductions.

Unlike traditional employees who have taxes automatically withheld, independent contractors must handle estimated quarterly payments, self-employment taxes, and complex deduction tracking on their own. This comprehensive guide covers everything US and international freelancers need to know about tax compliance, from essential forms and deadlines to advanced strategies for reducing your tax burden legally.

Important Disclaimer: This guide is based on personal research and publicly available resources. It is not legal or tax advice and should not be substituted for consultation with a licensed tax professional. Always consult a certified tax professional before making major tax-related decisions.

Understanding Independent Contractor Tax Responsibilities

Working as an independent contractor offers incredible freedom, but it comes with tax responsibilities that catch many freelancers off guard.

Unlike traditional employees who have taxes automatically withheld from their paychecks, independent contractors must handle every aspect of their tax obligations personally.

This includes:

-

Income tax,

Self-employment tax

estimated quarterly payments

Maximizing legitimate business deductions

The distinction between employee and independent contractor isn’t just semantic—it fundamentally changes how the IRS treats your income and what tax obligations you face.

The IRS uses three primary criteria to determine worker classification:

-

Behavioral control (who controls how work is performed)

Financial control (who controls business aspects of the job)

The type of relationship (contracts, benefits, permanency)

Understanding this classification is crucial because misclassification can lead to significant tax consequences and penalties.

When you work as an independent contractor, you’re essentially running a business, even if it’s a business one.

This means you’re responsible for tracking income from all sources, maintaining detailed records of business expenses, making quarterly estimated tax payments, and filing the appropriate tax forms.

The complexity increases when you consider that independent contractor taxes often involve paying more in self-employment taxes than traditional employees pay in payroll taxes.

Essential Tax Forms for Independent Contractor Taxes

Navigating freelancer taxesfreelancer taxes requires familiarity with several key IRS forms, each serving a specific purpose in your tax filing process.

Form W-9 is typically the first form you’ll encounter when working with new clients.

This Request for Taxpayer Identification Number provides your legal name, business name (if applicable), address, and taxpayer identification number—usually your Social Security Number or Employer Identification Number.

Clients use this information to prepare your 1099-NEC at year-end, so accuracy is critical.

Form 1099-NEC

Reports non-employee compensation and is issued by clients who pay you $600 or more during the tax year.

These forms must be provided to you by January 31st of the following year.

However, your obligation to report income exists regardless of whether you receive a 1099-NEC.

Some clients may fail to issue these forms, forget to send them, or have incorrect information, but you’re still legally required to report all income on your tax return.

Schedule C (Form 1040)

Where you report your business profit or loss from independent contractor work.

This form allows you to detail your business income from all sources and subtract legitimate business expenses to arrive at your net profit or loss.

The information from Schedule C flows to your main tax return and determines both your income tax and self-employment tax obligations.

Accurate completion of Schedule C is essential for maximizing deductions while staying compliant with IRS requirements.

Schedule SE

Calculates your self-employment tax, which covers Social Security and Medicare contributions for independent contractors.

Unlike employees who split these costs with their employers, independent contractors pay both the employee and employer portions, totaling 15.3% of net earnings.

However, you can deduct half of your self-employment tax as an adjustment to income on your main tax return, which helps offset this additional burden.

Mastering Estimated Tax Payments

Estimated tax payments represent one of the most critical aspects of independent contractor taxes, yet they’re often misunderstood or ignored entirely.

Since no employer withholds taxes from your payments, you must make quarterly estimated tax payments if you expect to owe $1,000 or more in taxes for the year.

This isn’t a suggestion—it’s a legal requirement that carries penalties and interest charges for non-compliance.

Calculating estimated taxes requires projecting your annual income, business expenses, deductions, and credits. Form 1040-ES provides worksheets to help with these calculations, but the process can be complex for contractors with fluctuating incomes.

Start by estimating your total business income for the year, subtracting your business expenses to get net profit, and then calculating both income tax and self-employment tax on that amount. Divide the total by four to determine your quarterly payment amount.

The IRS sets specific due dates for estimated tax payments that don’t align with calendar quarters.

Payments are due April 15th, June 15th, September 15th, and January 15th of the following year.

Missing these deadlines can result in penalties and interest charges, even if you’re entitled to a refund when you file your annual return.

The penalty calculations are complex and based on current interest rates, making timely payments essential for avoiding unnecessary costs.

You have several payment options for estimated taxes, with electronic methods generally being more convenient and secure.

IRS Direct Pay allows you to pay directly from your bank account using the IRS website. The Electronic Federal Tax Payment System (EFTPS) provides more features for business users and allows you to schedule payments in advance.

While you can still mail checks, electronic payments offer confirmation, faster processing, and reduced risk of lost payments.

For contractors with irregular income, managing estimated taxes requires ongoing attention throughout the year.

If your income increases significantly, you may need to adjust your remaining quarterly payments to avoid underpayment penalties.

Conversely, if your income drops, you might be able to reduce future payments or claim the safe harbor provisions that protect you from penalties if you pay at least 100% of last year’s tax liability (110% if your prior year adjusted gross income exceeded $150,000).

Maximizing Deductions for Independent Contractor Taxes

Business deductions represent your most powerful tool for reducing taxable income and minimizing your independent contractor tax burden.

Every legitimate business expense reduces your net profit dollar-for-dollar, lowering both your income tax and self-employment tax obligations.

However, deductions must meet the IRS criteria of being both “ordinary” (common in your industry) and “necessary” (helpful and appropriate for your business).

The home office deduction often provides significant savings for independent contractors who work from home.

You can choose between the simplified method (deducting $5 per square foot up to 300 square feet) or the actual expense method (calculating the percentage of your home used exclusively for business and deducting that percentage of home expenses).

The simplified method offers convenience, while the actual expense method might provide larger deductions if you have high home expenses or use a large space exclusively for business.

Vehicle expenses for business use can be substantial, but you must choose between the standard mileage rate method or the actual expense method for the entire year.

The standard mileage rate (56 cents per mile for 2021, with annual adjustments) covers all vehicle costs except parking fees and tolls.

The actual expense method requires detailed tracking of all vehicle costs and calculating the business-use percentage. Keep meticulous records of business mileage, including the purpose of each trip, destinations, and dates.

Health insurance premiums paid for yourself, your spouse, and dependents can be deducted above the line if you’re self-employed and not eligible for employer-sponsored coverage.

This deduction reduces your adjusted gross income, providing tax savings on both income tax and self-employment tax. Long-term care insurance premiums may also qualify, subject to age-based limits.

Professional development expenses, including courses, books, seminars, conferences, and certifications that maintain or improve skills required for your current business, are deductible.

However, education that qualifies you for a new trade or business generally isn’t deductible.

Software subscriptions, professional memberships, trade publications, and online learning platforms used for business purposes qualify as legitimate deductions.

Marketing and advertising expenses encompass a broad range of activities, including website development and maintenance, social media advertising, business cards, brochures, networking events, and promotional materials.

These expenses are fully deductible in the year incurred and can significantly impact your tax liability if you invest heavily in business promotion.

Understanding State and Local Tax Obligations

Independent contractor taxes extend beyond federal obligations to include various state and local requirements that vary significantly by location.

State income tax rates and rules differ dramatically, with some states having no income tax while others impose rates exceeding 10%.

Some states tax all income regardless of source, while others provide exemptions for certain types of independent contractor work.

Sales tax obligations can affect independent contractors who sell products or certain services.

Many states now require sales tax collection on digital products and services, including consulting, design work, and online courses.

Registration requirements, tax rates, and filing frequencies vary by state, making compliance complex for contractors working across state lines.

Some states have economic nexus rules that create tax obligations based on sales volume or transaction count, even without physical presence.

Local business licensing and tax requirements add another layer of complexity to independent contractor taxes.

Many cities and counties require business licenses for independent contractors, often with associated fees and ongoing renewal requirements.

Some localities impose additional taxes on business income or gross receipts. Research your specific location’s requirements, as penalties for non-compliance can be substantial, and ignorance isn’t considered a valid defense.

Professional licensing requirements may also create tax obligations in certain industries. Licensed professionals often face additional fees, continuing education requirements, and specialized tax rules. Some states impose franchise taxes on certain business structures, while others have minimum tax requirements regardless of income level.

Advanced Tax Planning Strategies

Effective tax planning for independent contractor taxes requires year-round attention rather than last-minute scrambling during tax season.

Setting aside 25-30% of each payment in a dedicated tax savings account helps ensure you have funds available for quarterly payments and annual tax obligations.

This percentage should be adjusted based on your tax bracket, state taxes, and business expense levels.

Monthly financial reviews help you stay on top of your tax situation and make necessary adjustments throughout the year.

Track your income against projections, monitor business expenses, and evaluate whether your estimated tax payments remain appropriate.

This ongoing attention prevents year-end surprises and allows you to take advantage of tax-saving opportunities before deadlines pass.

Business structure decisions can significantly impact your independent contractor taxes, particularly as your income grows.

While most independent contractors start as sole proprietors, forming an LLC or electing S-corporation status can provide tax advantages and liability protection.

S-corporation election can reduce self-employment tax by allowing you to pay yourself a reasonable salary (subject to payroll taxes) while taking additional distributions that aren’t subject to self-employment tax.

Retirement planning offers powerful tax advantages for independent contractors through vehicles like Solo 401(k) plans, SEP-IRAs, and SIMPLE IRAs.

These accounts allow much higher contribution limits than traditional IRAs, with Solo 401(k) plans permitting contributions up to $58,000 annually (plus catch-up contributions if you’re over 50). Contributions reduce your current tax liability while building retirement security.

Year-end tax planning provides opportunities to optimize your tax situation before the books close.

Consider accelerating business expenses into the current year if it provides tax benefits, making additional retirement contributions, or deferring income to the following year if appropriate.

Equipment purchases, professional development expenses, and business setup costs can often be timed strategically for maximum tax benefit.

International Considerations for Non-U.S. Contractors

Non-U.S. independent contractors working for American clients face unique tax challenges that require careful attention to avoid costly mistakes. U.S. tax law generally subjects non-resident aliens to a 30% withholding tax on U.S.-sourced income, which can significantly impact your earnings if not properly managed.

However, proper form filing and tax treaty benefits can dramatically reduce or eliminate this withholding.

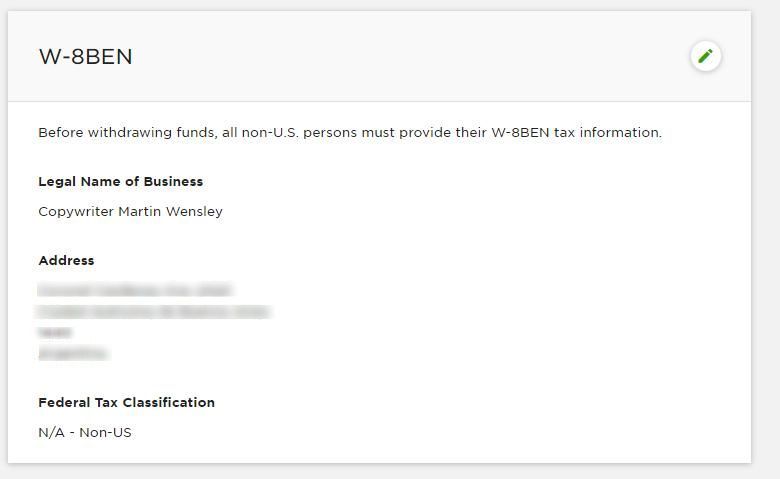

Form W-8BEN (for individuals) or W-8BEN-E (for business entities) are critical documents that certify your foreign status and allow you to claim tax treaty benefits if your country has a tax treaty with the United States.

These forms must be provided to U.S. clients before payments begin, and they’re typically valid for three years. Without these forms, clients are required to withhold the full 30% tax rate, which may exceed your actual tax liability.

Tax treaties between countries often provide reduced withholding rates or exemptions for certain types of income. Common treaty benefits include reduced rates for royalties, dividends, and service income.

Some treaties provide complete exemptions for independent contractor income under specific circumstances.

Research your country’s tax treaty with the United States to understand available benefits and ensure you’re claiming them properly.

There is no grace period where non-U.S. contractors are exempt from U.S. tax obligations. If you’re earning income from U.S. sources, you’re subject to U.S. tax requirements from the first dollar earned.

This misconception has led many international contractors into compliance problems with significant penalties and interest charges.

Consult with tax professionals familiar with international tax law to ensure proper compliance.

The concept of “effectively connected income” (ECI) applies to non-U.S. contractors who have significant U.S. business activities. ECI is generally taxed at regular U.S. tax rates rather than the flat 30% rate, but it requires filing a U.S. tax return and may create additional obligations.

Understanding whether your income qualifies as ECI requires careful analysis of your activities and business structure.

Freelance Platform Tax Compliance

Popular freelancing platforms like Upwork, Fiverr, and Freelancer.com have streamlined tax compliance for many contractors, but understanding their processes remains important for proper tax planning.

U.S.-based contractors typically complete Form W-9 during platform registration, while international contractors submit Form W-8BEN or W-8BEN-E. These forms determine how the platform handles tax reporting and withholding.

Platform tax reporting varies significantly in format and timing. Some platforms issue consolidated 1099-NEC forms showing total annual earnings, while others provide detailed transaction reports that you must use to calculate total income.

Many platforms also provide tax documents through online portals rather than mailing physical forms. Regardless of the format, you’re responsible for accurately reporting all platform income on your tax returns.

The responsibility for accurate income reporting remains entirely with you, regardless of what tax documents you receive or don’t receive from platforms.

Platform technical issues, delayed 1099 forms, or incorrect reporting don’t excuse you from proper tax compliance.

Maintain your detailed records of all platform earnings, including those below the $600 1099 reporting threshold.

International contractors using U.S.-based platforms must pay particular attention to tax withholding and reporting.

Some platforms automatically withhold taxes for international users who haven’t provided proper W-8 forms, while others may not withhold anything despite tax obligations existing.

Understanding your platform’s specific policies and ensuring proper form submission prevents unexpected tax complications.

Record Keeping and Documentation

Meticulous recordkeeping forms the foundation of successful independent contractor tax management and audit protection.

The IRS can audit tax returns up to three years after filing (six years for substantial underreporting), making detailed documentation essential for defending your deductions and income reporting.

Digital tools and cloud storage provide convenient options for organizing and preserving tax records securely.

Income documentation should include all 1099 forms, client payment records, platform statements, and bank deposit records.

Create a system for tracking payments that don’t generate 1099 forms, including cash payments, international client payments, and payments from clients who pay less than $600 annually. Reconcile your records with tax documents you receive to identify any discrepancies that need investigation.

Expense documentation requires receipts, invoices, bank statements, and detailed logs for certain categories like vehicle use and home office expenses.

The IRS expects contemporaneous records, meaning you should document expenses when they occur rather than reconstruct them later.

Digital receipt scanning apps and cloud storage solutions make this process more manageable while providing backup protection.

Mileage logs must include the date, destination, business purpose, and miles driven for each business trip.

The IRS is particularly strict about vehicle expense documentation, requiring detailed logs rather than estimates or reconstructed records. Many smartphone apps can automate mileage tracking using GPS, reducing the administrative burden while improving accuracy.

Common Mistakes and Audit Protection

Independent contractor taxes present numerous opportunities for costly mistakes that can trigger audits or penalties.

Mixing personal and business expenses is one of the most common errors, leading to disallowed deductions and potential penalties.

Maintain separate business bank accounts and credit cards to clearly distinguish business from personal expenses.

Failing to report all income represents a serious compliance risk, particularly with the IRS’s increasing use of automated matching systems.

The IRS receives copies of all 1099 forms and cross-references them with tax returns. Unreported income typically triggers automated notices and can lead to audits with associated penalties and interest charges.

Aggressive deduction positions without proper documentation invite IRS scrutiny and audit risk.

While you should claim all legitimate deductions, ensure you have proper documentation and business justification for each expense.

The “ordinary and necessary” standard requires that expenses be both common in your industry and helpful for your business.

Home office deduction mistakes are particularly common and often trigger audits. The space must be used exclusively and regularly for business purposes.

Using your dining room table for occasional work doesn’t qualify, but a dedicated office space does. Mixed-use spaces require careful documentation of business versus personal use.

Estimated tax underpayment penalties can be avoided by understanding the safe harbor provisions and making timely payments.

If you pay at least 100% of last year’s tax liability through withholding and estimated payments (110% if your prior year’s AGI exceeded $150,000), you generally avoid penalties regardless of your current year’s liability.

Professional Help and Tax Software Options

The complexity of independent contractor taxes often justifies professional assistance, particularly as your business grows and becomes more complex.

Tax professionals bring expertise in current tax law, audit protection, strategic planning, and time savings that can more than offset their fees.

This isn’t just for high-earning contractors—smart contractors at all income levels recognize the value of professional guidance.

Certified Public Accountants (CPAs) provide the highest level of tax expertise and can represent you before the IRS in case of audits or disputes.

Enrolled Agents (EAs) specialize in tax matters and also have IRS representation privileges.

Many tax professionals offer year-round services, including quarterly estimated tax calculations, business structure advice, and strategic tax planning.

Tax software has become increasingly sophisticated for independent contractor taxes, with many programs handling complex scenarios like multiple business activities, international income, and advanced deductions.

Popular options include TurboTax, TaxAct, FreeTaxUSA, and H&R Block, each offering different features and pricing structures.

Professional versions often include features like prior-year comparisons, audit support, and business planning tools.

The decision between professional help and tax software depends on your situation’s complexity, comfort level with tax concepts, available time, and cost considerations.

Simple independent contractor situations might be handled effectively with quality tax software, while complex scenarios involving multiple income sources, international clients, or significant business expenses often benefit from professional assistance.

Conclusion: Building Long-Term Tax Success

Mastering independent contractor taxes requires ongoing education, meticulous record-keeping, and strategic planning rather than just annual compliance.

The tax landscape continues evolving with new legislation, IRS guidance, and economic changes that affect independent contractors.

Staying informed about these changes helps you maintain compliance while optimizing your tax situation.

Building good tax habits from the beginning of your independent contractor career pays dividends throughout your business journey.

Set aside money for taxes with every payment, track expenses as they occur, make timely estimated payments and review your situation regularly.

These habits become automatic with practice and provide peace of mind during tax season.

The freedom of independent contractor work comes with the responsibility of managing your taxes effectively.

While the obligations may seem overwhelming initially, understanding the requirements and building good systems makes the process manageable.

Remember that tax compliance isn’t just about avoiding penalties—it’s about building a sustainable business that supports your long-term goals.

Whether you choose to handle your independent contractor taxes yourself or work with professionals, the key is taking action and staying compliant.

The IRS provides extensive resources for independent contractors, and professional help is available when needed.

Your freelancing success depends not just on finding clients and delivering great work but also on managing the business side effectively, with taxes being a critical component.

Final Disclaimer: This comprehensive guide provides general information about independent contractor taxes based on research and publicly available resources. Tax laws are complex and change frequently, and individual situations vary significantly. This guide is not a substitute for professional tax advice. Always consult with qualified tax professionals for guidance specific to your situation before making important tax-related decisions.

© Martin Wensley 2018-2025 — Independent Contractor Taxes